Industry spotlight: the rise of big data in marine

From finance to security services, the term ‘big data’ has become almost ubiquitous. And if it sounds like the sort of thing that people go to sea to avoid, then take note: even the yachting sector is flirting with the concept.

The phrase ‘big data’ was coined in the 1990s to describe novel ways of mining large quantities of information for useful trends. But it wasn’t until the digital age that data really became big – accompanied by a new generation of statistical tools, software and hardware capable of making sense of it all.

Companies have been understandably cautious to dig into these opportunities, which have spurred real controversy about privacy. The automotive sector has led the way. Tesla owners are willing to pay £10 per month to stream video, music and real-time mapping to their cars. But whether you pay or not, the car will send video it has recorded while driving as well as a host of other data back to Tesla’s servers for analysis.

It is helping the company to develop artificial intelligence potentially capable of driving our cars safely, and McKinsey estimates that such data could be worth well over $250bn by the end of the decade – a staggering sum.

Boat ownership is much narrower than that of cars so, of course, the pool of data is smaller. But with the advanced electronics now routinely fitted to modern boats – from sophisticated navigation kit to audiovisual and remote monitoring – the scope is just as great.

Some industry players have already realised it; Groupe Beneteau has recently introduced a tool it has branded Seanapps, which allows users to remotely monitor the status of their boats. The basic black box can be retrofitted for €1,319 and there is a €219 annual subscription charge. While the boat owner is checking the battery levels, GPS position and air temperature on board, Beneteau can also garner anonymous data. The system won’t align specific information with a specific boat, unless owners have agreed to let it, but at the very least the data feeds into an anonymised database.

“Our goal is to help all the Groupe Beneteau brands improve the customer journey,” explains Luc Joessel, communication project manager at Beneteau. “With a better knowledge of our customers and the way they use our boats we will make sure our products and innovations are matching their expectations.”

Many of the company’s sailing boats have been built Seanapps-ready since August 2021, and this is being extended to cover every brand by autumn 2022.

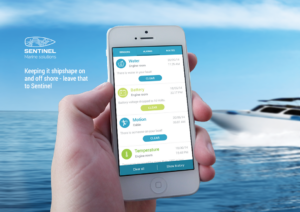

It is based on technology from Sentinel Marine, which also supplies the world’s number two yacht builder, Hanse Yachts AG.

For two years, Hanse’s new boats have contained the wiring and hardware necessary for connectivity at no extra cost to the owner, with the first two years of subscription to the My Safety Cloud app also free. There are undoubtedly major benefits to the boat owner, but it also allows Hanse to read engine parameters, such as rpm and run time.

“From that we can initiate engine servicing plans,” says Hanse project manager Johannes Schlieben. “We have plans in the next six to 12 months where we want to compare boat performance with weather data. We can sense wind conditions on a sailboat and how fast the boat was going. So, we could get more insights about performance parameters of the boat.”

Schlieben believes the business has invested north of €1 million in the project over the last three years, with annual costs of at least €250,000. He says that no-one is quite sure how to use the data yet – not least because of strict EU rules on what can be collected, and for what purposes. “We are currently trying to understand what is legally possible, and where the benefits would be,” he adds. “Automotive people have found a set-up so they can use these things.”

Schlieben believes the business has invested north of €1 million in the project over the last three years, with annual costs of at least €250,000. He says that no-one is quite sure how to use the data yet – not least because of strict EU rules on what can be collected, and for what purposes. “We are currently trying to understand what is legally possible, and where the benefits would be,” he adds. “Automotive people have found a set-up so they can use these things.”

Last year, MIN reported that Groupe Beneteau would be introducing hybrid and electric craft in 2022.

Hanse 588

Of course, boatbuilders are not the only ones looking to use data gleaned from on board. Marine electronics brands from Raymarine to B&G are gathering data about how owners use their kit online and offline, with a view to improving the interface and building more compelling products.

Engine manufacturers could also benefit from more data use. Volvo Penta’s larger marine diesels from the 110hp D3 upwards are electronically controlled and already interface with NMEA 2000 instrument networks, while its smaller engines can be connected up using an extra adapter. The aim, according to Johan Inden, president of Volvo Penta, is to develop a network of connected vessels.

“Across the Volvo Group, we have over a million connected vehicles operating across the world,” he says. “What we have learned, based on more than 20 years of connected products, is that you have to link it very, very closely to the experience and customer value you’d want to establish. How do we really make sure we enrich the experience and don’t just end up shuffling data with little value?”

Realising this value is something that kept MDL Marinas sales and marketing director Tim Mayer, busy for about nine months during the first lockdown in the UK. He brought in the Tunisian firm Acteol to help set up a system that would collate customer data from across the business into a single customer view. That’s over 7,000 berth holders in 20 different marinas.

“The data sits at the core of everything we do,” Mayer explains. “It gives you a much more rounded vision of what that customer looks like and the value to the business. Based on their behaviour, it allows you to plan future strategies.”

Aggregating data from multiple sources is the same sort of thing that Google or Facebook do. With that overview of how often berth holders visit their boats, and for how long, whether they prefer the on-site bar or the restaurant, and how much they’re spending on refit and maintenance work, MDL can fine-tune its messaging. “It means we can pull the correct target audience for any message at any time. You can build much more detail,” Mayer adds.

And the bottom line? While he won’t talk cold, hard cash, Mayer does say advertising aimed at specific customer groups by the new system has produced an uplift in spending. In July, customers who were not targeted by the system visited their boats on average 2.6 times, while those who had received a promotional message came 3.11 times. In December the difference is even starker: 1.75 visits versus 2.6 in the month.

“It’s a fairly big investment,” Mayer admits, “but it’s a commercial decision. We haven’t spent elsewhere. The amount of time we would have spent pulling various bits of info – it’s paid for itself.”